Type and Duration

FFF-Förderprojekt, June 2018 until December 2021 (finished)Coordinator

Chair in FinanceMain Research

Wealth ManagementField of Research

Behavioural FinanceDescription

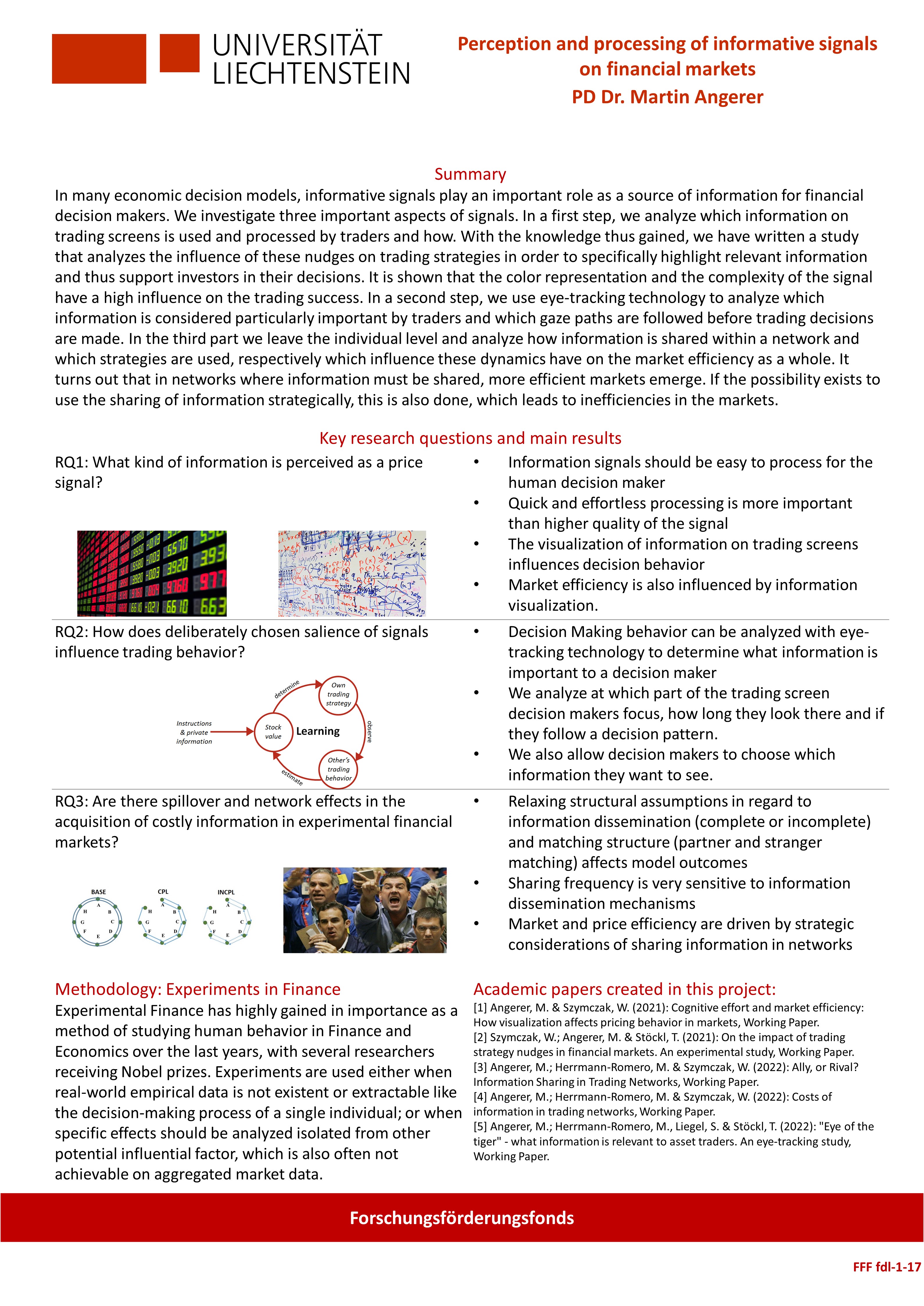

Many decision-making models highlight the importance of informative signals as a relevant source of information on financial markets. However, although this importance is undisputed as such, we know only little about what kind of signals gain our attention, how we can increase salience of specific information sources, how we perceive different types of signals and how they influence our decision behavior.In this project we concentrate on experimental asset markets and focus on three important aspects of signals. First, we look at existing trading screens and analyze what kind of information gets the most attention by traders. In a second step, we will use the produced knowledge and analyze how specific information sources that are objectively important can be visualized so that they become more salient, hence get more attention and therefore lead to enhanced investor behavior. In a third step we loosen the assumption that signals are provided for free. We analyze how costly information is spread (un-)willingly over the market and how trader networks process and buy information.

In a nutshell, we want to examine the importance of signals, the influence of manipulation in salience of signals, and the costly acquisition of signals in networks. To this end, we will conduct experimental asset market studies and study individual trader behavior and market outcomes. The results deliver important academic evidence, but are also highly valuable information for practitioners, who can learn about the visualization and processing of informative signals. This not only helps to improve trading strategies and trading platforms to achieve better trading returns, but might also contribute to a stabilization of the financial system because of a reduction or elimination of bubbles and crashes triggered by irrational behavior.

Project results:

Principal Investigator

Professor

Project Collaborator

Publications

Herrmann-Romero, M., Liegl, S., Angerer M., & Stöckl, T. (2022). Golden Eye - How Traders Screen Information. Presented at the World Finance, Turin, Italy.

moreHerrmann-Romero, M., Liegl, S., Angerer M., & Stöckl, T. (2022). Golden Eye - How Traders Screen Information. Presented at the 37. AWG, Klagenfurt, Austria.

moreHerrmann-Romero, M., Angerer, M., & Szymczak, W. (2022). Ally or Rival - Information Sharing in Trading Networks. Presented at the World Finance, University of Turin.

moreHerrmann-Romero, M., Angerer, M., & Szymczak, W. (2022). Ally or Rival - Information Sharing in Trading Networks. Presented at the Experimental Finance Conference, University of Bonn.

more